The industry needs practical ways to move forward to stimulate recovery.

Airlines need efficient distribution because they’re strapped for financial resources and people who understand the complexity of airline distribution—from content creation to settlement. Systems need reliable data to build their tools that support complex flight shopping.

There’s an emerging concept that can effectively enable airlines to achieve their distribution vision in this constrained environment—interoperability. ATPCO’s Graham Wareham and Chris Phillips explain what it is and why it’s so important now.

A tough journey to new thinking

CP: Graham, we’ve worked on and off together for more than 10 years to contribute to a new airline distribution model that enables airlines to deliver better financial results. Despite the challenges, some airlines have found ways to optimize new distribution capability in their commercial model and realize the benefits.

GW: Yes, it’s been an interesting journey. Migrating airline distribution from a technically driven solution to a more commercial, retail-driven solution was never going to be easy. On top of that, the commercial challenges of making this shift have been significant. But I think we have turned a corner.

CP: When we started, people talked about re-building the entire distribution model from content creation to settlement. They wanted to move beyond processes and technology limits that were preventing access to the full value of airlines’ networks and product offerings.

CP: One of the ambitions was to improve the relevance of offers to shoppers by better understanding “who was asking.” Airlines saw better sales returns through direct channels where they understood shopper intent and delivered results that were more meaningful. Unfortunately, airlines didn’t see most of the shopping requests and didn’t know who their customers were until a ticket was issued and they showed up at the airport for check-in.

GW: That’s right. Airlines recognized that when they had more direct customer engagement, they had a better understanding of shopping behavior and could build an offer that would resonate. The power of understanding that data and creating a relevant offer is the foundation of effective retailing.

New Distribution Capability models = incremental improvements through retailing

CP: When we talk about traditional distribution, we think about airlines filing fares, publishing flight schedules, granting access to availability, and having someone else create an offer on behalf of the airline. Small, incremental improvements to every transaction through better retailing can have a dramatic effect on airline profitability.

GW: That’s a core objective of New Distribution Capability (NDC)—unlocking those incremental improvements. In an NDC environment, most airlines still use ATPCO for filing their base content, OAG for the schedule, and their own availability. But now, the airline is creating the offer they believe has the most relevance to a specific shopping request. The more they know, the more targeted or relevant the offer will be.

Direct connections and NDC offer more transparency and better control to airlines—but right now it only applies to a small portion of the airline’s total sales potential. Negotiated or private fares like corporate or consolidator programs, groups, and interline itineraries continue to be gaps that have not been solved in NDC.

Flight shopping isn’t magic—there’s intricate data behind the curtain

CP: The nature of the industry creates immense complexity. It’s frequently overlooked that a shopper can request a complex, global itinerary with multiple cities and airlines and get an answer in seconds. How this happens is not magic. Processing these more complicated journeys requires intricate data in an infrastructure the industry has been relying on for decades.

Requirements like corporate travel, interline settlement, and handling reissues have not been fully solved yet by NDC, so airlines would either have to recreate each one of those functions and connections themselves, or distribution systems would each be building structures to handle them. We would essentially be right back where we started: in an overly complex environment.

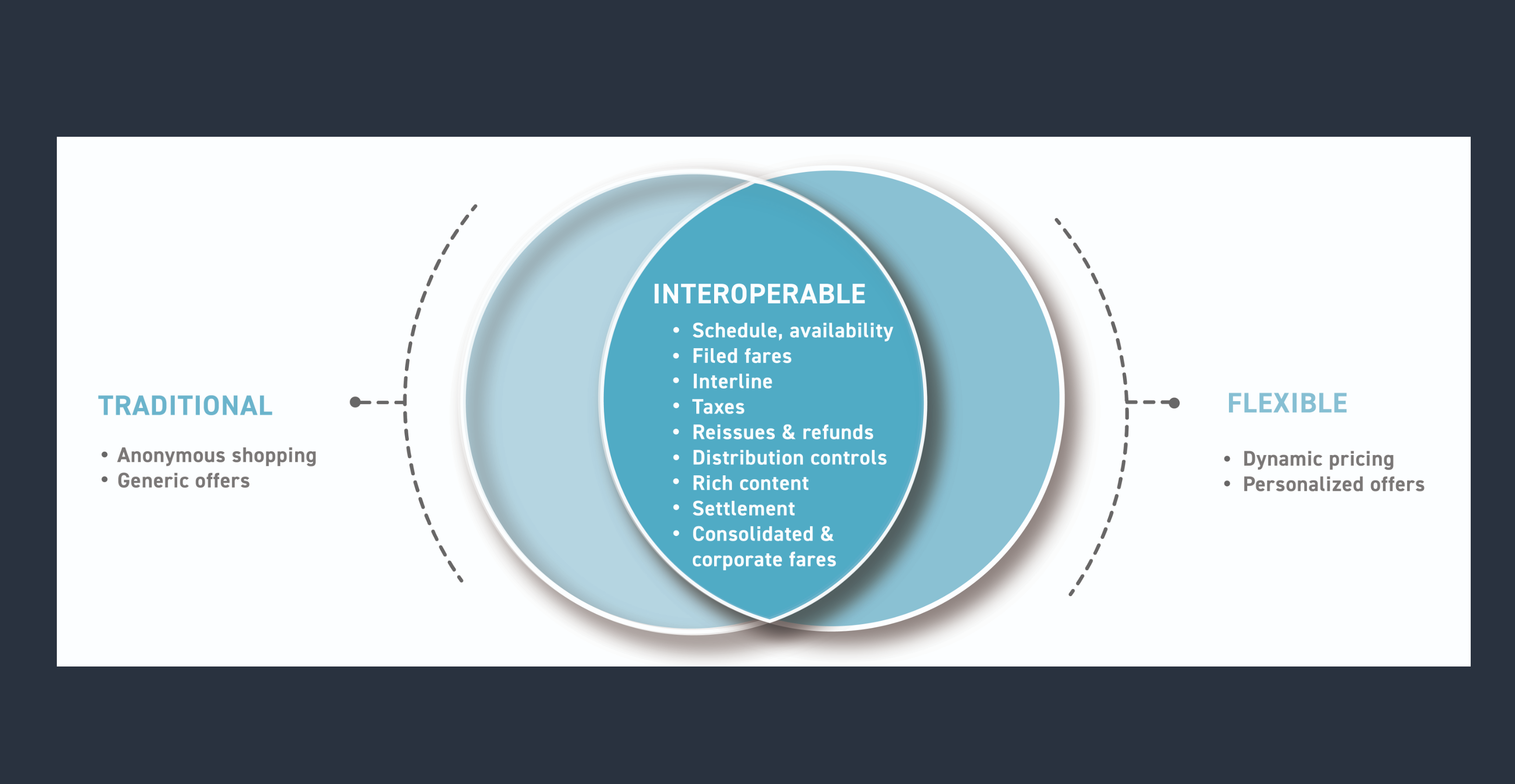

GW: So, the key to scaling NDC to satisfy those gaps is to simplify the process of NDC shopping for all—which is where the idea of interoperability comes in.

As you said, the original goal of NDC was a replacement of the entire distribution model from the old to the new, moving offer construction from third parties to airlines so they could interact better with customers. Over the last 12 years we’ve learned that replacing everything we do today with new technology just doesn’t make sense. Interoperability gives us a path to consider what parts of the “old” we can use to support the “new.”

Building the best of two worlds

CP: Interoperability is taking the best of the current distribution process and enriching it with the innovation both customers and airlines demand and that NDC has enabled. Can you give me an example of where blending the best of both worlds creates a better outcome that a complete rebuild?

GW: The distribution of private fares like corporate and consolidator programs is a great example. All the stuff that controls who sees what content, who can do what in the system, works very efficiently in today’s private fares and Fare by Rule standards. Why would you build massive credential management databases that everyone has to code in order to handle existing data that already does what we need NDC to do? Why don’t we just keep what works well and add on the pieces that take it to the next level?

The current crisis has really put a spotlight on this issue. The entire industry is struggling with cash flow, and capital investment has been reduced to near zero. It’s been repeatedly proven that effective airline retailing drives better financial performance, but how do we unlock those benefits with limited resources?

CP: It’s all the plumbing. A full-on replacement of everything is just not efficient or even possible. Leveraging existing infrastructure to bring consolidated fares and corporate fares into NDC would be a big win in the NDC world. It immediately opens up a previously underrepresented channel for NDC to achieve those benefits.

GW: If you want to realize the benefits of what the NDC model can deliver, you need a reliable and scalable infrastructure. At ATPCO, we are looking for infrastructure gems that ATPCO already supports or can be easily enhanced to support all airlines, GDSs, and sales channels.

Everyone using NDC could point to this common infrastructure, and then add in their “secret sauce” privately to differentiate themselves in the market. The trick is finding the gems that resonate with the airlines and gain their support. Developing these scalable industry infrastructure components can greatly expedite getting to scale with NDC. Collaborating as an industry makes it better for everyone when you have a single infrastructure you can build your own tools on.

CP: New tools and modern concepts, even the simpler flavors of dynamic pricing, are all based on fare filing and fare infrastructure. Our future state still leans on the past.

GW: Yes. Dynamic pricing is interesting and has the potential to create tremendous value for airlines. The airlines testing it today are all taking wildly varying approaches to support their specific needs. Many of them are creating offers based on the core data that sits on ATPCO today, using merchandising engines or dual RBD to optimize revenue.

Interoperability offers a smarter way

It doesn’t make sense from an efficiency standpoint to design mechanisms for both traditional and flexible distribution methods, because they use the same foundational data.

This is why interoperability should be top of mind as we move toward recovery. We will collectively need to focus our limited resources on solutions that will create the most value and not invest in repetitive functionality.

Talk to ATPCO. We’re working to make your hard days easier by supporting both legacy and emerging distribution worlds.